Indian banks operate under increasingly strict security and compliance expectations set by the Reserve Bank of India.

RBI’s cybersecurity and IT governance frameworks now clearly extend beyond digital controls to include physical security, environmental monitoring, and time-bound incident response.

For banks, this means one thing:

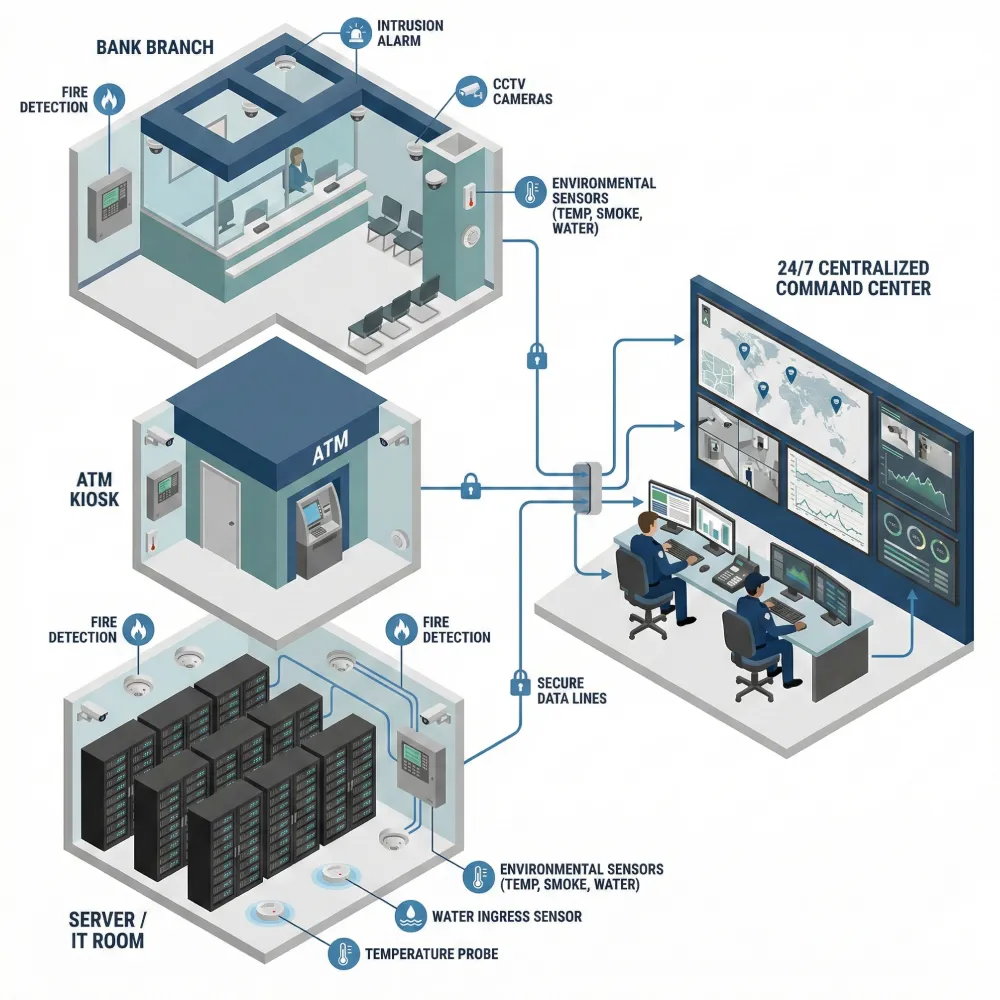

Installed security systems are no longer enough. Continuous monitoring is essential.

RBI security guidelines require banks to:

Without 24/7 centralized alarm monitoring, meeting these expectations consistently—especially during nights, weekends, and holidays—is operationally impractical.

⚠️ RBI inspections increasingly highlight that standalone CCTV or unmonitored alarms do not meet compliance intent.

While RBI mandates CCTV deployment, recording footage alone is insufficient.

RBI expects:

Only integrated, actively monitored systems satisfy these expectations.

A Central Monitoring Station acts as the security nerve center for banks by:

For RBI compliance, monitoring uptime matters as much as detection accuracy.

RBI explicitly requires monitoring of:

In Indian conditions—high heat, humidity, and power fluctuations—environmental failures can shut down banking operations faster than cyber incidents.

Banks that ignore environmental alerts risk service disruption, audit observations, and reputational damage.

Imported alarm systems often fail under

Indigenous systems engineered for Indian conditions ensure continuous compliance across diverse geographies, from metro branches to remote ATMs.

An RBI-aligned alarm monitoring solution must support:

This solution framework is designed for:

India’s trusted security partner since 2013. Made in India manufacturer of 24/7 monitored alarm systems.

© 2013-2025 Atigo Security — A division of Atigo Enterprises Limited

Made in India. Monitored in India.