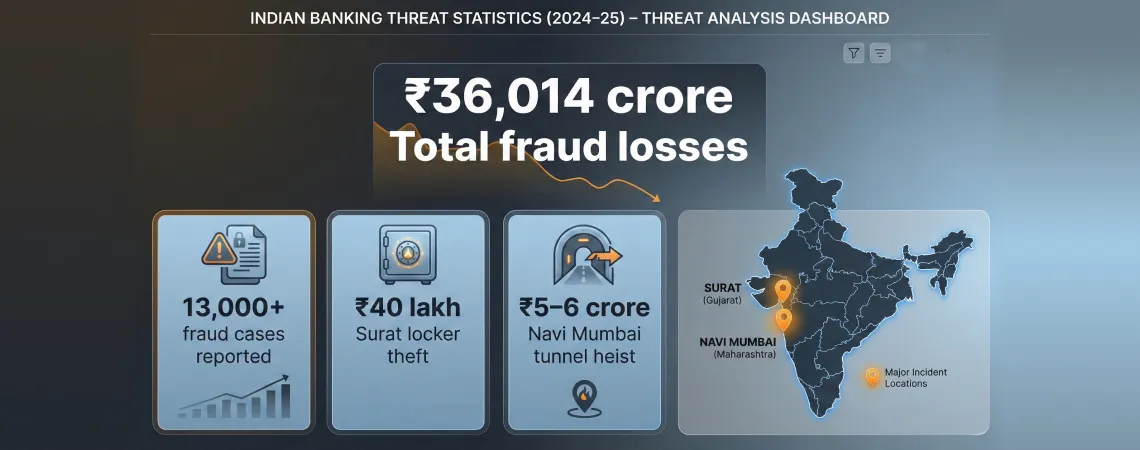

The Indian banking sector faces an unprecedented crisis in physical security. According to the Reserve Bank of India’s annual report, banking fraud losses surged to ₹36,014 crore in FY 2024-25—representing a staggering 194% increase over the previous year. While this figure includes various fraud categories, physical security breaches from ATM thefts to branch robberies continue to represent significant vulnerabilities that traditional security approaches fail to address.

The numbers tell a sobering story:

🚨 Branch Break-Ins: Physical break-ins remain common, with criminals employing increasingly sophisticated methods including:

Indian banks face distinctive security challenges that require specialized solutions:

🌡️ Environmental Factors: India’s extreme climate conditions—temperatures exceeding 40°C and humidity levels reaching 90%—cause many imported security sensors to fail, creating vulnerabilities that criminals exploit.

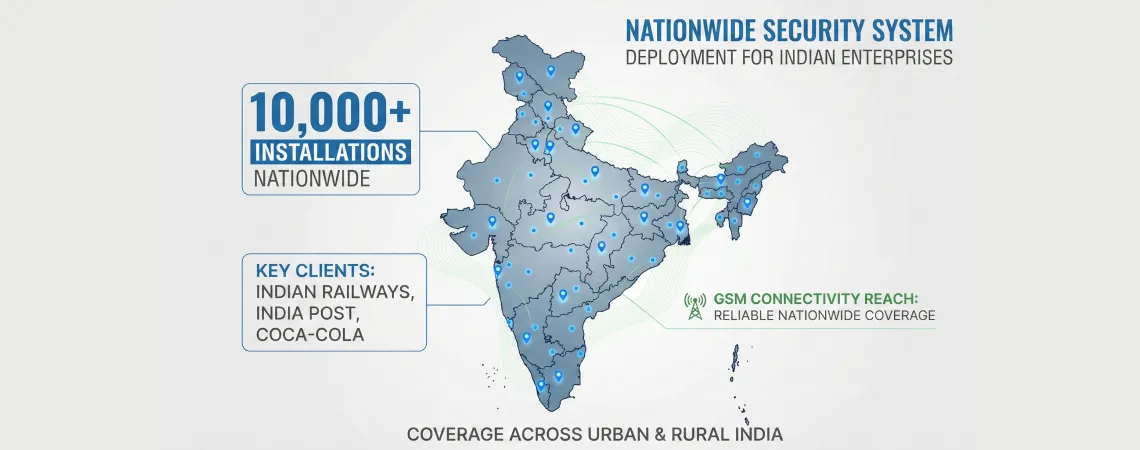

🗺️ Geographic Spread: With thousands of bank branches and ATMs spread across urban and rural India, maintaining consistent physical security presents logistical challenges.

💵 Cost Constraints: Many regional and cooperative banks operate on tight budgets, often viewing comprehensive security as expensive rather than as essential risk mitigation.

🌙 After-Hours Vulnerability: Most physical security incidents occur during nights, weekends, and holidays when branches are unmanned and response times are slowest.

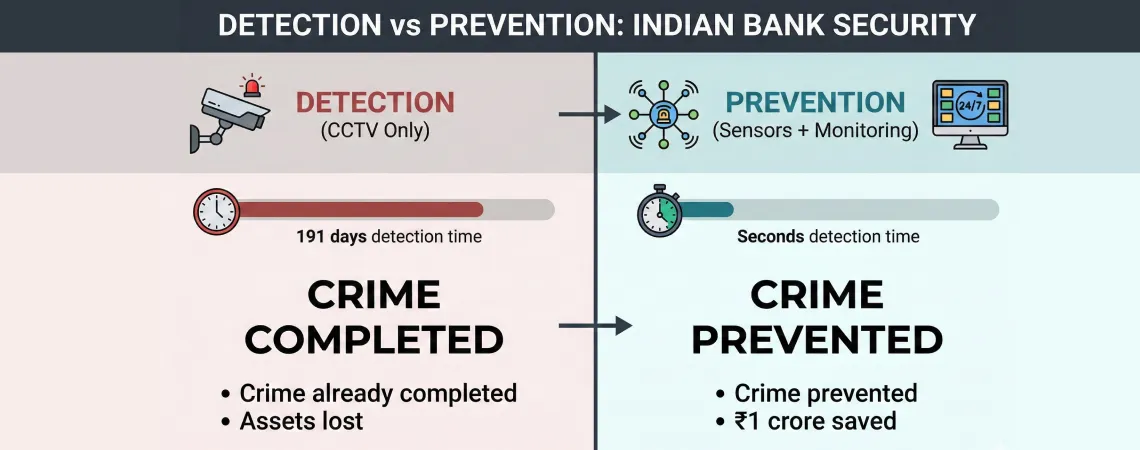

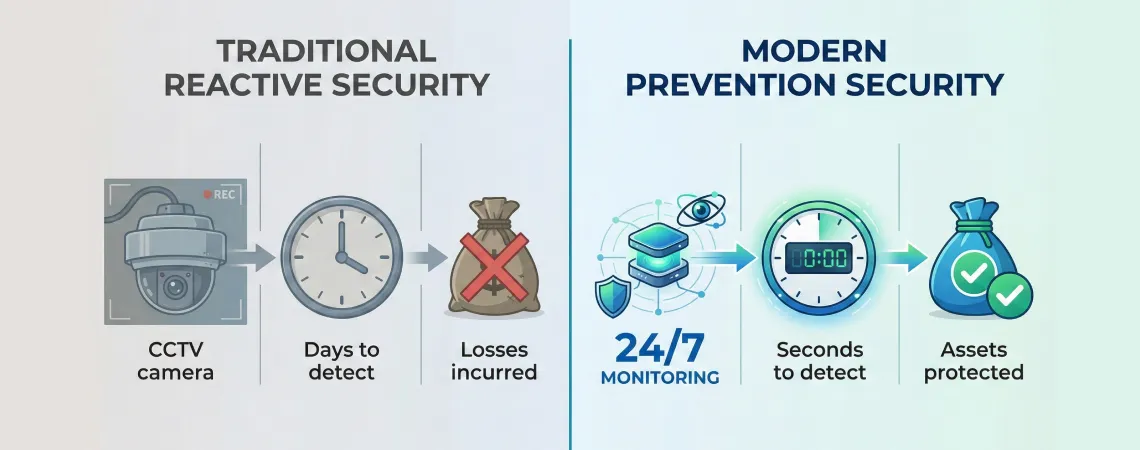

Many Indian banks believe comprehensive CCTV coverage provides adequate physical security. It doesn’t. Cameras are purely reactive tools—they record crimes after they’ve occurred but rarely prevent them.

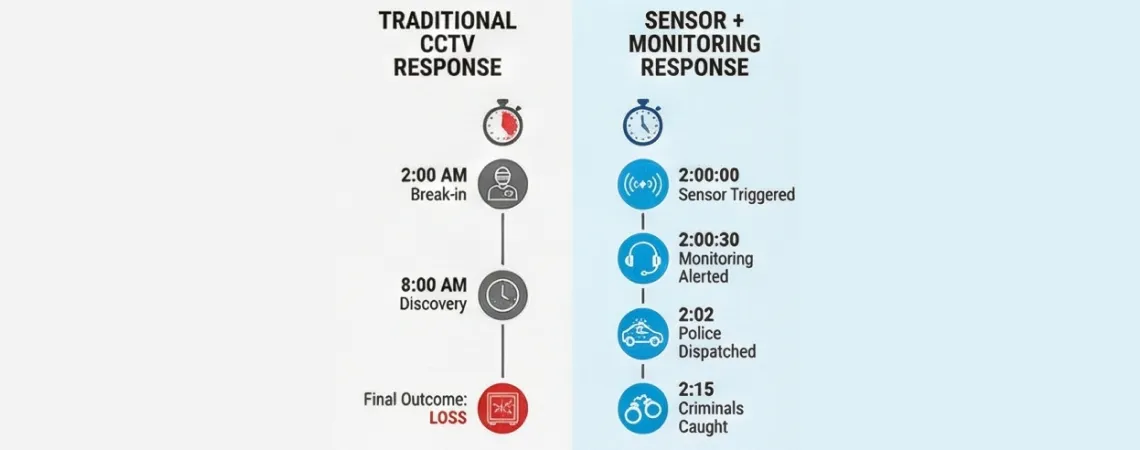

Consider this typical scenario:

2:00 AM: Criminals break into a bank branch

2:05 AM: Traditional CCTV records the event

2:10 AM: Basic alarm system triggers

8:00 AM: Staff discovers the breach

Result: Lakhs of rupees and sensitive documents missing

CCTV systems have their place in security infrastructure—they provide valuable evidence for investigations and can deter opportunistic crimes. However, cameras alone cannot stop determined criminals, especially when there’s no one actively monitoring the feeds in real-time or when sophisticated criminals know how to avoid or disable camera coverage.

Standard alarm systems suffer from critical limitations that render them ineffective against determined criminals:

❌ No Verification Capability: Alarms alert that something happened, not what happened or who is responsible. Without verification, police often deprioritize responses.

❌ High False Alarm Rates: According to security industry research, false alarms account for up to 98% of all alarm activations, costing businesses billions annually in wasted emergency response resources and creating “alert fatigue” among security personnel.

❌ Delayed Response: Without immediate professional verification, critical minutes—or even hours—elapse before appropriate action is taken.

❌ Easy Circumvention: Experienced criminals know how to disable or work around simple alarm systems, especially when there’s no active monitoring.

Perhaps most critically, traditional approaches deploy isolated solutions—CCTV in one corner, basic alarms somewhere else, manual locks on doors, with no integration or communication between systems.

This fragmentation creates exploitable gaps:

Sophisticated criminals exploit these gaps systematically, knowing that siloed systems provide fragmented visibility and slow response times.

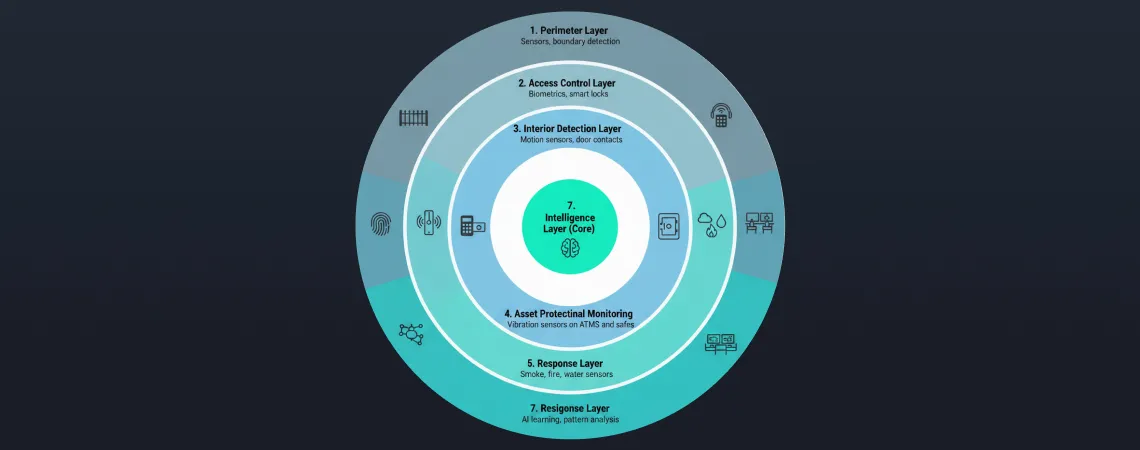

Forward-thinking Indian banks are abandoning reactive security for prevention-focused physical security ecosystems that stop threats before they materialize. These comprehensive platforms integrate multiple technologies into a unified defense system that detects, analyzes, verifies, and responds autonomously—often before criminals can complete their intended acts.

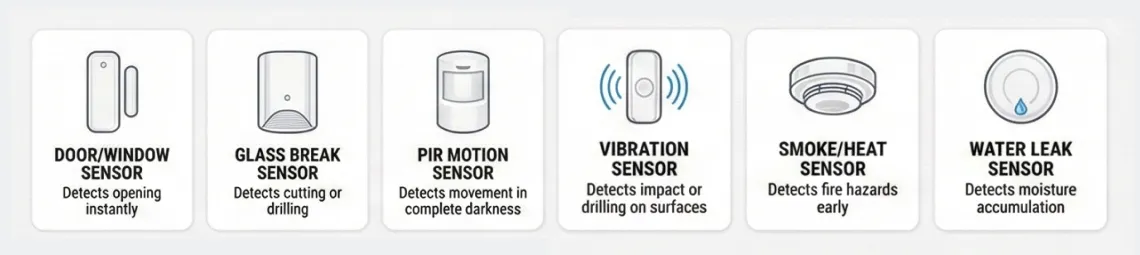

1. Perimeter Layer (sensors, boundary detection)

2. Access Control Layer (biometrics, smart locks)

3. Interior Detection Layer (motion sensors, door contacts)

4. Asset Protection Layer (vibration sensors on ATMs, safes)

5. Environmental Monitoring (smoke, fire, water sensors)

6. Response Layer (24/7 monitoring center)

7. Intelligence Layer (AI learning, pattern analysis) Alt Text: “Seven-layer physical security defense ecosystem for Indian banks showing perimeter to intelligence protection”

Modern security ecosystems often incorporate intelligent video surveillance as one component of layered defense. Banks can integrate AI-powered video analytics with their existing or new camera systems to enhance detection capabilities:

This is the foundation of prevention-focused security. Sensor networks create an invisible security perimeter that detects physical intrusions immediately—before crimes are completed:

This real-time detection is what transforms security from reactive documentation to proactive prevention.

✅ Trigger instant alerts the moment intrusion occurs | ❌ Requires someone watching screens 24/7 |

✅ Work in complete darkness | ⚠️ Limited visibility in darkness |

✅ Work through obstacles and walls | ❌ Blind spots always exist |

✅ Reduced monitoring load (event-driven alerts) | ❌ Resource-intensive constant monitoring |

✅ Lower bandwidth (minimal data transmission) | ❌ High bandwidth for video streaming |

✅ Cost-effective comprehensive coverage | 💰 Higher cost for comparable coverage |

✅ Reliable in extreme Indian climate | ⚠️ May fail in heat/humidity |

Modern alarm systems leverage cloud-based platforms to provide instant connectivity across all sensors and control points. This integration enables

⚡ Technical Advantage: Events that once took minutes or hours to communicate now trigger responses in seconds. This speed differential often determines whether crimes are prevented or merely documented.

📡 GSM Connectivity: For branches in remote areas or locations with unreliable internet, GSM-based connectivity ensures alarm systems remain operational and connected to monitoring centers through cellular networks.

This is where prevention becomes reality. Professional monitoring centers staffed by trained security specialists provide the crucial human intelligence layer that transforms technology into protection.

✅ Immediate Threat Verification: When sensors trigger, trained operators immediately assess the alert within seconds. They review the sensor type, location, time, and pattern to verify whether it’s a genuine threat or false alarm.

🚨 Rapid Response Coordination: Verified threats trigger immediate police dispatch with priority response. Monitoring centers provide law enforcement with precise location information, threat type, and real-time updates—resulting in faster, more targeted responses than unverified automatic alarms.

🔍 Multi-Layered Verification: Professional monitoring can integrate with video systems (where available) for visual confirmation, use multiple sensor correlation to validate threats, and employ intelligent assessment protocols that reduce false dispatches.

🌙 Continuous Coverage: Criminals deliberately target nights, weekends, and holidays when they assume banks are least vigilant. Professional 24/7 monitoring eliminates this vulnerability entirely—there’s always a trained security professional watching over your facilities.

📞 Escalation Management: Clear standard operating procedures ensure threats are communicated to the right people at the right time—branch managers, security heads, local police, and emergency services as appropriate.

📊 Measurable Impact: Research consistently demonstrates that continuous professional monitoring provides dramatic advantages:

Modern access control goes far beyond traditional lock-and-key security:

👆 Biometric Authentication: Fingerprint, facial recognition, or iris scanning ensures only authorized personnel access restricted areas.

💳 Smart Card Systems: RFID or NFC-enabled cards that log every entry and exit, creating detailed audit trails.

⏰ Time-Based Access Rules: Automatically restrict access to specific areas during certain hours, preventing after-hours unauthorized entry.

🔔 Real-Time Monitoring: Security managers receive instant alerts when restricted areas are accessed, enabling immediate verification and response.

🔐 Multi-Factor Authentication: Combine biometrics, cards, and PIN codes for high-security areas like vaults and server rooms.

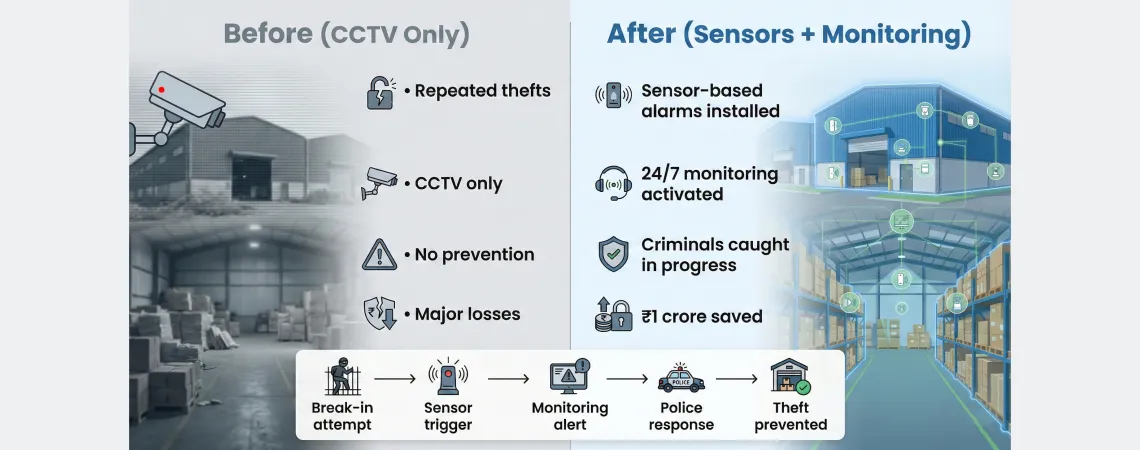

A white goods warehouse in Uttar Pradesh had been repeatedly targeted by thieves, suffering multiple break-ins despite having basic CCTV cameras. The facility implemented a comprehensive sensor-based alarm system with 24/7 professional monitoring—notably, without relying on CCTV verification.

Police arrived while the crime was still in progress. Criminals were apprehended on-site, and over ₹1 crore worth of goods was recovered—goods that would have been lost with traditional security approaches that merely record crimes after completion.

The UP warehouse case illustrates critical advantages of sensor-based systems:

1. ⚡ Instant Detection: Sensors trigger the moment intrusion occurs, not when someone reviews footage

2. 🌙 Works in Darkness: Criminals often disable lights; sensors work regardless of visibility

3. 👁️ No Blind Spots: Properly deployed sensors cover all entry points; cameras always have coverage gaps

4. 📊 Reduced Monitoring Load: 24/7 monitoring of dozens of video feeds is resource-intensive; sensor alerts are event-driven and manageable

5. 📡 Lower Bandwidth: Sensor data transmission requires minimal connectivity compared to video streaming

6. 💰 Cost Effectiveness: Comprehensive sensor coverage costs significantly less than comparable camera coverage

7. 🌡️ Environmental Resilience: Sensors designed for Indian conditions operate reliably in extreme heat, humidity, and dust

Recent incidents across India illustrate the consequences of reactive security:

❌ Surat locker break-in: Despite CCTV presence, thieves successfully broke six lockers and escaped with ₹40+ lakh. Cameras recorded the crime but didn’t prevent it.

❌ Navi Mumbai tunnel theft: Criminals spent days tunneling under a bank, breaking 30 lockers, stealing ₹5-6 crore—all undetected until discovery. CCTV showed the aftermath, not the crime in progress.

❌ Multiple ATM jackpotting incidents: Repeated successful attacks on the same ATMs, indicating security systems failed to adapt or prevent recurrence.

Common factors: Detection occurred after crime completion, CCTV footage aided investigation but didn’t prevent losses, and lack of real-time sensor-based monitoring with professional response allowed criminals extended timeframes to complete their objectives.

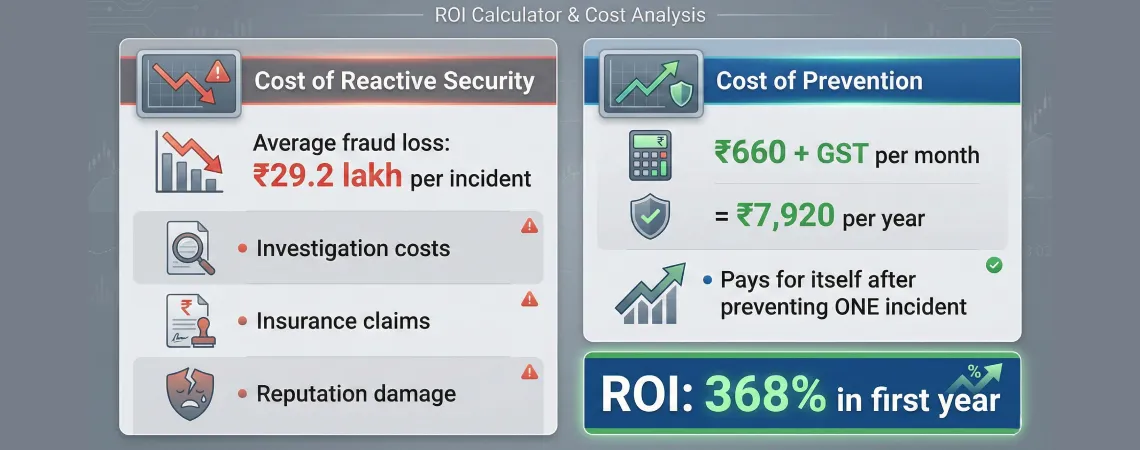

Security skeptics often view comprehensive systems as expensive. The data tells a different story:

💡 Breaking the Cost Barrier: Professional alarm monitoring services are more accessible than many banks assume. Services like those offered by Atigo start from just ₹660 plus GST per month—a fraction of the potential loss from a single successful break-in.

📊 Investment Perspective: Consider that:

From this perspective, comprehensive monitoring isn’t an expense—it’s one of the highest-ROI investments a bank can make.

🌡️ Environmental Resilience: Many imported security sensors fail in India’s harsh climate conditions—40°C+ temperatures, 90% humidity, dust, and power fluctuations. Domestically engineered alarm systems like Atigo are specifically designed and tested for Indian environmental conditions, ensuring reliable operation year-round.

🇮🇳 Local Support and Service: Domestic manufacturers provide local technical support, faster response times for service issues, and better understanding of Indian banking operational requirements.

💰 Cost Effectiveness: Eliminating import costs and leveraging local manufacturing makes advanced security monitoring more affordable for Indian banks.

📜 Regulatory Alignment: Indian manufacturers design systems with RBI requirements and Indian banking operations in mind from the ground up.

✅ Proven Track Record: Atigo’s deployment across 10,000+ installations nationwide, protecting critical infrastructure including Indian Railways, India Post, and major corporate entities, demonstrates proven effectiveness in Indian conditions.

📡 GSM Connectivity: Understanding that many Indian bank branches operate in areas with unreliable internet connectivity, systems like Atigo use GSM-based connectivity to ensure continuous monitoring coverage even in remote locations.

Modern security ecosystems work best when specialized vendors provide best-in-class solutions for their areas of expertise:

🔐 Sensor-Based Alarm Systems & Monitoring: Core intrusion detection, environmental monitoring, and 24/7 professional monitoring services (providers like Atigo)

📹 Video Surveillance: CCTV systems and AI-powered video analytics from specialized camera vendors

🚪 Access Control: Biometric and smart card systems from access control specialists

🔗 The Integration Advantage: Rather than seeking a single vendor for all components, banks benefit from choosing best-of-breed solutions that integrate through open platforms and standard protocols. This approach:

✅ Allows selection of the most reliable technology for each function

✅ Prevents vendor lock-in

✅ Enables phased upgrades without replacing entire systems

✅ Provides flexibility to add new technologies as they emerge

🎯 Central Monitoring Platform: The key is having a unified monitoring and alert platform (often provided by your alarm monitoring service) that aggregates data from all security components—sensors, cameras, access control—into a single operational view.

For banks implementing comprehensive security, the most cost-effective starting point is sensor-based alarm systems with professional monitoring because:

1. 💰 Immediate ROI: Prevention capability starts from day one of monitoring service

2. 📉 Lower Initial Investment: Sensor coverage costs less than comprehensive camera coverage

3. ✅ Proven Effectiveness: As demonstrated in the UP warehouse case, sensors alone can prevent crimes

4. 📈 Scalable Foundation: Once alarm infrastructure is established, cameras and other components can be added incrementally

5. 🌐 Universal Applicability: Every bank location benefits from sensor-based intrusion detection

6. 📅 Implementation Sequence:

Before implementing comprehensive security ecosystems, banks should conduct thorough assessments:

📋 Current State Analysis:

🎯 Risk Prioritization:

Calculate potential loss exposure at each facility

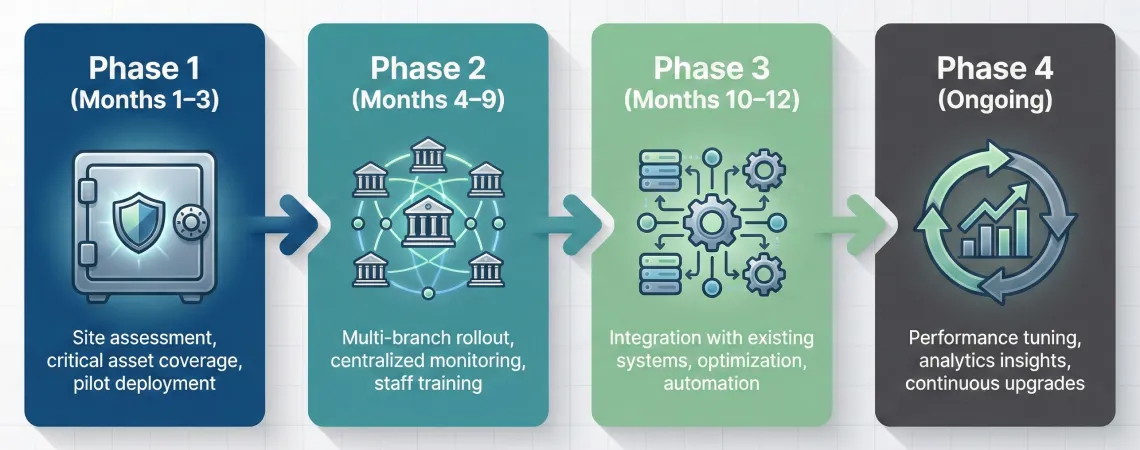

Banks don’t need to transform security overnight. Strategic phased implementation allows risk-based prioritization while managing costs:

Implement sensor-based alarm systems with 24/7 monitoring at:

📊 Expected Outcome: Critical assets protected, immediate risk reduction

Extend sensor and monitoring coverage to:

📊 Expected Outcome: Comprehensive coverage across branch network

Integrate additional security components:

📊 Expected Outcome: Unified security ecosystem with centralized management

📊 Expected Outcome: Adaptive security posture that evolves with threats

Not all security systems are created equal. When evaluating alarm systems and monitoring services, Indian banks should assess:

✅ Reality: At ₹660+ GST per month for professional monitoring, sensor-based alarm systems are more affordable than most banks realize. Consider:

💡 Example: Even a small cooperative bank with 5 branches pays just ₹3,300/month (₹660 × 5) for comprehensive 24/7 monitoring—less than the cost of one security guard at one location.

✅ Reality: CCTV systems can complement sensor-based alarm systems. Many banks discover that cameras record crimes without preventing them because there’s no real-time monitoring or immediate response capability. Adding sensor-based detection with 24/7 monitoring transforms your existing CCTV from reactive documentation to part of an integrated prevention system.

💡 Integration Benefit: Sensors detect → Monitoring verifies → Cameras provide evidence = Complete security

While the Reserve Bank of India’s Master Directions on Information Technology (issued November 2023, effective April 2024) primarily address cybersecurity, they establish important principles applicable to all security domains:

As Indian banks navigate 2026 and beyond, the physical security imperative is clear: prevention must replace detection as the primary goal. Traditional approaches—CCTV systems that merely record crimes, basic alarms that alert after breaches occur, siloed systems creating exploitable gaps—no longer provide adequate protection against evolving criminal tactics.

The future of banking physical security lies in sensor-based alarm systems with professional 24/7 monitoring as the foundation, complemented by other security technologies:

Comprehensive sensor networks for immediate intrusion detection

Comprehensive sensor networks for immediate intrusion detection Real-time connectivity enabling instant alert transmission

Real-time connectivity enabling instant alert transmission 24/7 professional monitoring for immediate human verification and intervention

24/7 professional monitoring for immediate human verification and intervention GSM connectivity ensuring reliable operation even in remote locations

GSM connectivity ensuring reliable operation even in remote locations Layered defense strategies that stop threats at multiple levels

Layered defense strategies that stop threats at multiple levels Integration capability allowing cameras, access control, and other systems to work together

Integration capability allowing cameras, access control, and other systems to work together

Systems like the Atigo Smart Security platform demonstrate what’s possible when sensor technology and human expertise unite in service of prevention. With proven results including successful interventions, significant asset recovery (like the ₹1 crore UP warehouse case achieved without CCTV), and measurable risk reduction, these alarm monitoring ecosystems represent the evolution Indian banking security has been waiting for.

The most important lesson from real-world implementations is simple:

Investing in sensor-based alarm systems with professional 24/7 monitoring at ₹660+ GST monthly provides immediate prevention capability. Banks can add cameras and other technologies later, but the foundation of prevention starts with comprehensive sensor coverage and professional monitoring response.

Taking Action

The choice facing bank leadership is straightforward:

The criminals are already sophisticated. The question isn’t whether threats will evolve—they will. The question is whether your security posture evolves faster.

In 2026, banking security isn’t about just having cameras and basic alarms anymore. It’s about having intelligent sensor-based detection with professional monitoring that responds immediately—preventing crimes before they’re completed.

That’s not just better security. That’s modern security

Join 10,000+ installations nationwide protecting critical assets with sensor-based prevention

Detection-based security records crimes after they happen (like CCTV footage reviewed later), while prevention-based security stops crimes before they’re completed through real-time sensor detection, immediate professional verification, and rapid emergency response. Prevention systems detect intrusion attempts as they begin, not after assets are lost.

Key difference: Detection shows you what was stolen; prevention stops the theft from happening.

Professional monitoring services start from just ₹660 plus GST per month with Atigo. Complete system costs vary based on facility size and sensor requirements, but phased implementation makes advanced security accessible even for smaller banks.

Important perspective: A single prevented major theft typically pays for years of monitoring. The average fraud incident (₹29.2 lakh) pays for 3.5 years of monitoring services.

Yes, absolutely. The Uttar Pradesh warehouse case study demonstrates that comprehensive sensor networks with professional monitoring effectively prevented a ₹1 crore theft without any CCTV verification.

Sensors provide immediate intrusion detection that enables rapid response coordination, while CCTV provides evidence after the fact. For prevention, sensors with monitoring are more effective than cameras alone.

Indian banks face multiple physical security threats including:

By the numbers: In FY 2024-25, banking fraud reached ₹36,014 crore across 13,000+ reported cases.

24/7 professional monitoring means trained security specialists watch your alarm systems around the clock, verify sensor alerts in real-time, and coordinate emergency responses.

Why it matters: Criminals target after-hours when banks are unmanned. Professional monitoring:

Yes. Modern alarm systems like Atigo use GSM connectivity that works anywhere with cellular coverage, eliminating dependence on internet infrastructure. This ensures continuous monitoring coverage even in rural areas where internet connectivity is unreliable or unavailable.

Simple rule: If your branch has mobile phone service, it can have professional security monitoring.

Implementation typically occurs in phases over 3-12 months depending on bank size.

Timeline breakdown:

Professional installers work during off-hours to minimize operational disruption.

Atigo sensors are specifically engineered for India’s extreme climate—40°C+ temperatures, 90% humidity, dust, and power fluctuations that cause many imported sensors to fail.

Proven reliability: With 10,000+ installations nationwide and proven effectiveness across diverse Indian conditions from Himalayan cold to coastal humidity, Atigo provides reliable year-round alarm detection.

Additional benefits: Local manufacturing, GSM connectivity for remote areas, and technical support understanding Indian banking operations.

Yes, absolutely. Modern alarm monitoring platforms can integrate with existing CCTV systems, creating a unified security ecosystem.

How it works: While cameras and sensors serve different purposes (cameras record, sensors detect), combining them with professional monitoring provides comprehensive coverage.

Recommended approach: Start with sensor-based alarms and monitoring for immediate prevention capability, then integrate cameras strategically to complement the system.

Yes, emphatically. Criminals often target smaller banks assuming weaker security.

Cost perspective: At ₹660+ GST monthly for monitoring, professional alarm monitoring is affordable even for smaller institutions. A 5-branch cooperative bank pays just ₹3,300/month total—less than one security guard’s salary.

ROI perspective: The average fraud incident (₹29.2 lakh) far exceeds years of monitoring costs, making prevention-focused security one of the best investments small banks can make.

1. Reserve Bank of India. (2024). “Annual Report 2024-25: Banking Fraud Statistics.” RBI Official Publications.

2. Statista. (2024). “Number of bank fraud cases across India from financial year 2009 to 2024.” Reserve Bank of India data. Retrieved from https://www.statista.com/statistics/1012729/india-number-of-bank-fraud-cases/

3. RMA India. (2025). “Bank Fraud Losses Surge to ₹36,014 Cr Despite Drop in Cases: RBI.” Retrieved from https://rmaindia.org/

4. India TV News. (2024). “Bank Robbery News & Updates.” Multiple incident reports including Surat, Jaipur, and Navi Mumbai cases. Retrieved from https://www.indiatvnews.com/topic/bank-robbery

5. Bajaj Finserv. (2025). “ATM Jackpotting: Understanding Threats & Prevention Strategies.” Retrieved from https://www.bajajfinserv.in/atm-jackpotting

6. International Journal of Scientific Research. (2024). “Advancements in ATM Security for Movement and Tampering Detection: A Review.” Retrieved from https://ijsrcseit.com

7. Reserve Bank of India. (2023). “Master Direction – Information Technology Framework for the NBFC Sector.” RBI/2023-24/107. Effective April 1, 2024.

8. Custom Market Insights. (2025). “ATM Security Market Size To Grow At A CAGR Of 6.8% From 2025 To 2034.” Retrieved from https://www.custommarketinsights.com

9. FTSI Corporation. (2025). “Protect Your ATMs Against Theft and Vandalism.” Security industry analysis and best practices.

10. Razorpay Learn. (2025). “What is ATM Fraud: Types And Preventing Tips.” Indian case studies and fraud statistics.

11. MSSP Security. (2025). “The Importance of 24/7 Security Monitoring Explained.” Research on monitoring effectiveness and cost reduction.

12. National Crime Records Bureau (NCRB). (2024). “Crime Rate Report of India 2024.” Government of India statistics.

Atigo provides comprehensive AIoT Smart Alarm Systems with 24/7 Emergency Monitoring Services specifically designed for Indian environmental conditions. Specializing in sensor-based intrusion detection with professional monitoring, Atigo’s systems are engineered to operate reliably in India’s extreme temperatures (40°C+), high humidity (90%+), and challenging power conditions.

With over 10,000 active installations nationwide and a proven track record protecting critical infrastructure including Indian Railways, India Post, Coca-Cola, Decathlon, Aditya Birla Grasim, Tata Tanishq, Adani Power, State Bank of India, and major corporate entities, Atigo combines advanced sensor technology with affordable monitoring services starting from just ₹660 plus GST per month.

Founded in 2013 after an MoU with the Government of Gujarat at the Vibrant Gujarat Summit, with a ₹250 crore investment commitment, Atigo has pioneered India’s indigenous physical security alarm technology sector. With R&D collaboration with IIT

Gandhinagar and state-of-the-art manufacturing facilities in Ahmedabad, Atigo represents truly Made-in-India security innovation built specifically for Indian challenges.

Atigo’s sensor-based alarm systems integrate seamlessly with existing security infrastructure including CCTV systems, access control, and other security components from specialized vendors, creating comprehensive security ecosystems with professional monitoring at the core.

Certifications: ISO 9001, CE Marking, RoHS Compliant, STQC Tested

📞 For Banking Security Solutions:

Visit www.atigosecurity.in or contact Atigo’s banking security specialists

📧 Email: sales@atigo.in

📱 Phone: 91 9099901674

🏢 Manufacturing & R&D:

Ahmedabad, Gujarat, India

India’s trusted security partner since 2013. Made in India manufacturer of 24/7 monitored alarm systems.

© 2013-2025 Atigo Security — A division of Atigo Enterprises Limited

Made in India. Monitored in India.